Payment fraud risk management

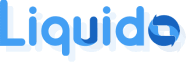

Decrease costs from fraudulent customer transactions and prevent chargebacks

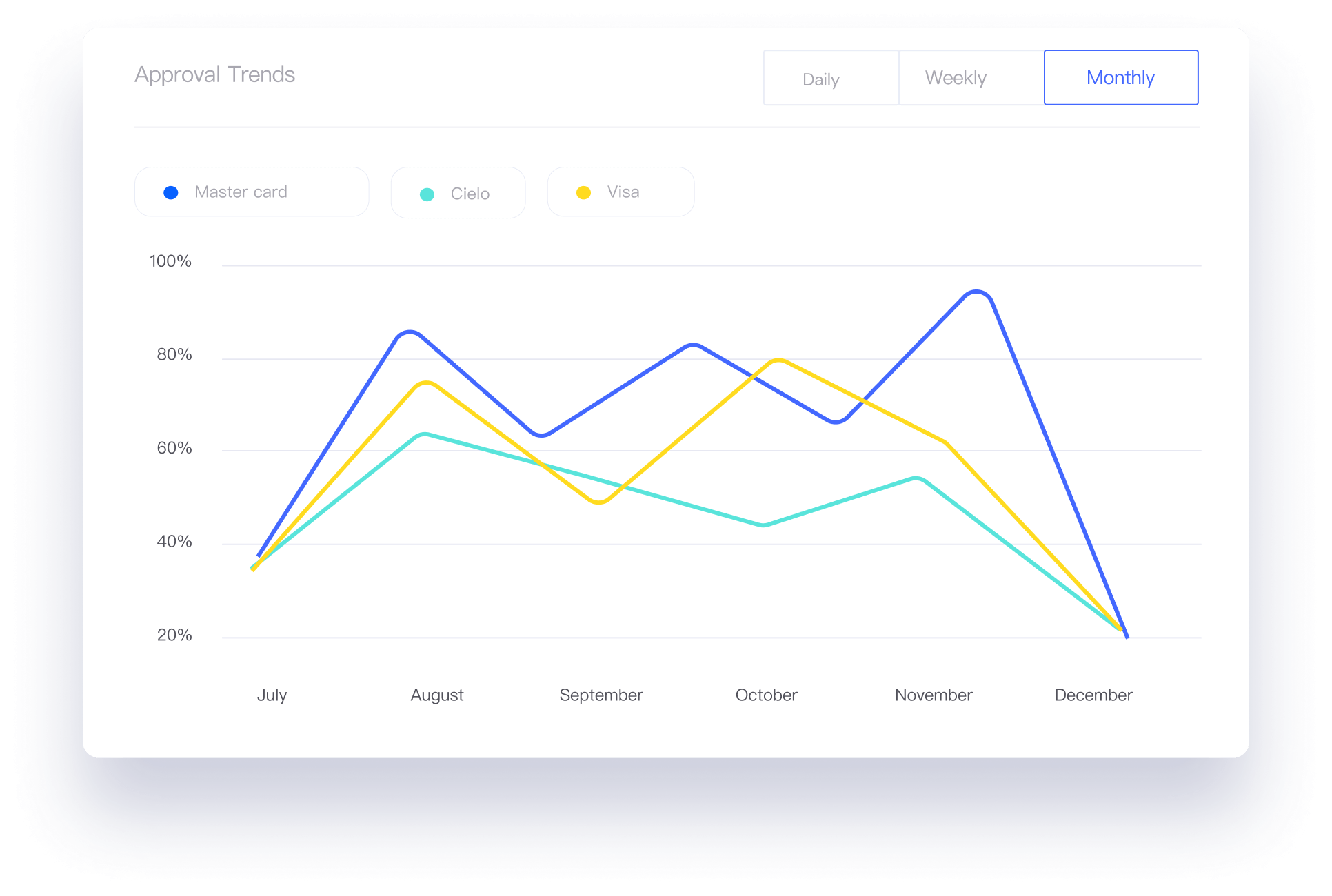

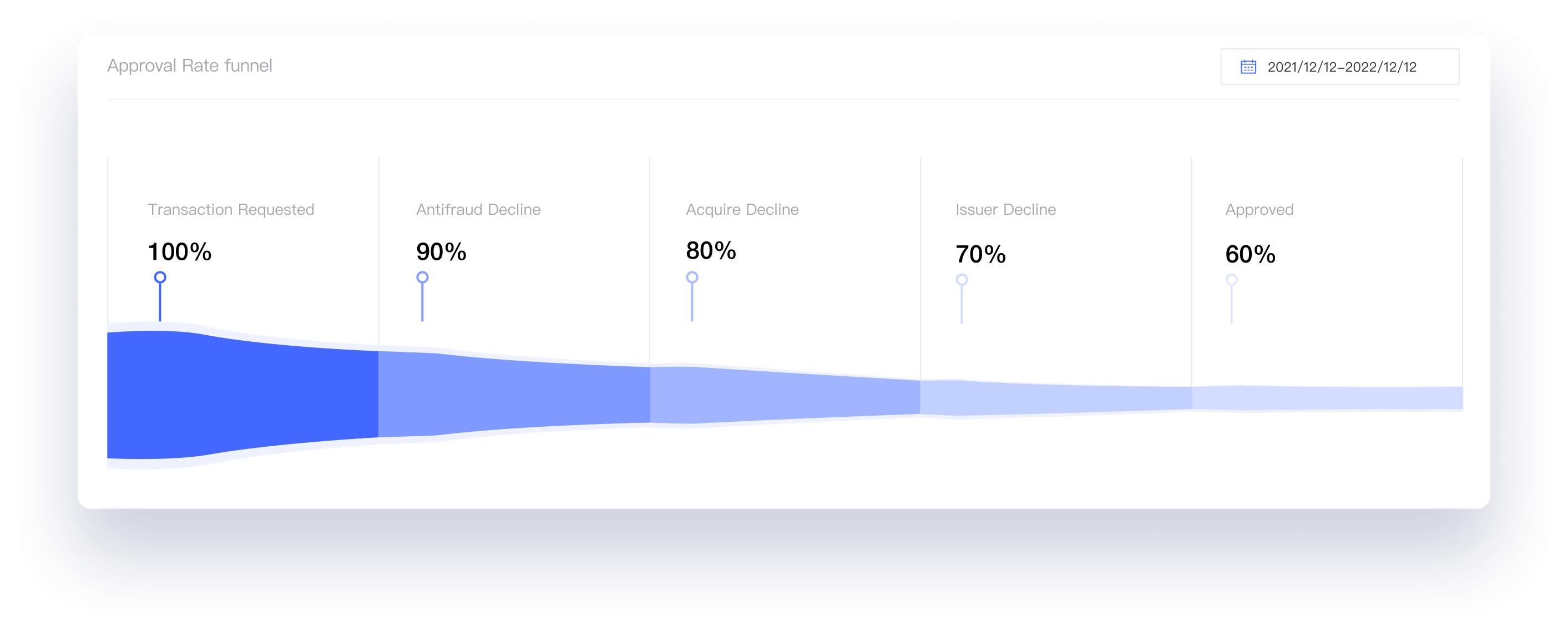

Increase precision of transaction approval to maximize business revenue

Improve efficiency of business operations through automation and business insights

React faster to changing trends and emerging fraud patterns

Improve customer experience by quickly and accurately approving legitimate transactions

Expert driven intelligent engine

Machine learning decision engine model copiloted by risk domain experts to deliver immediate value

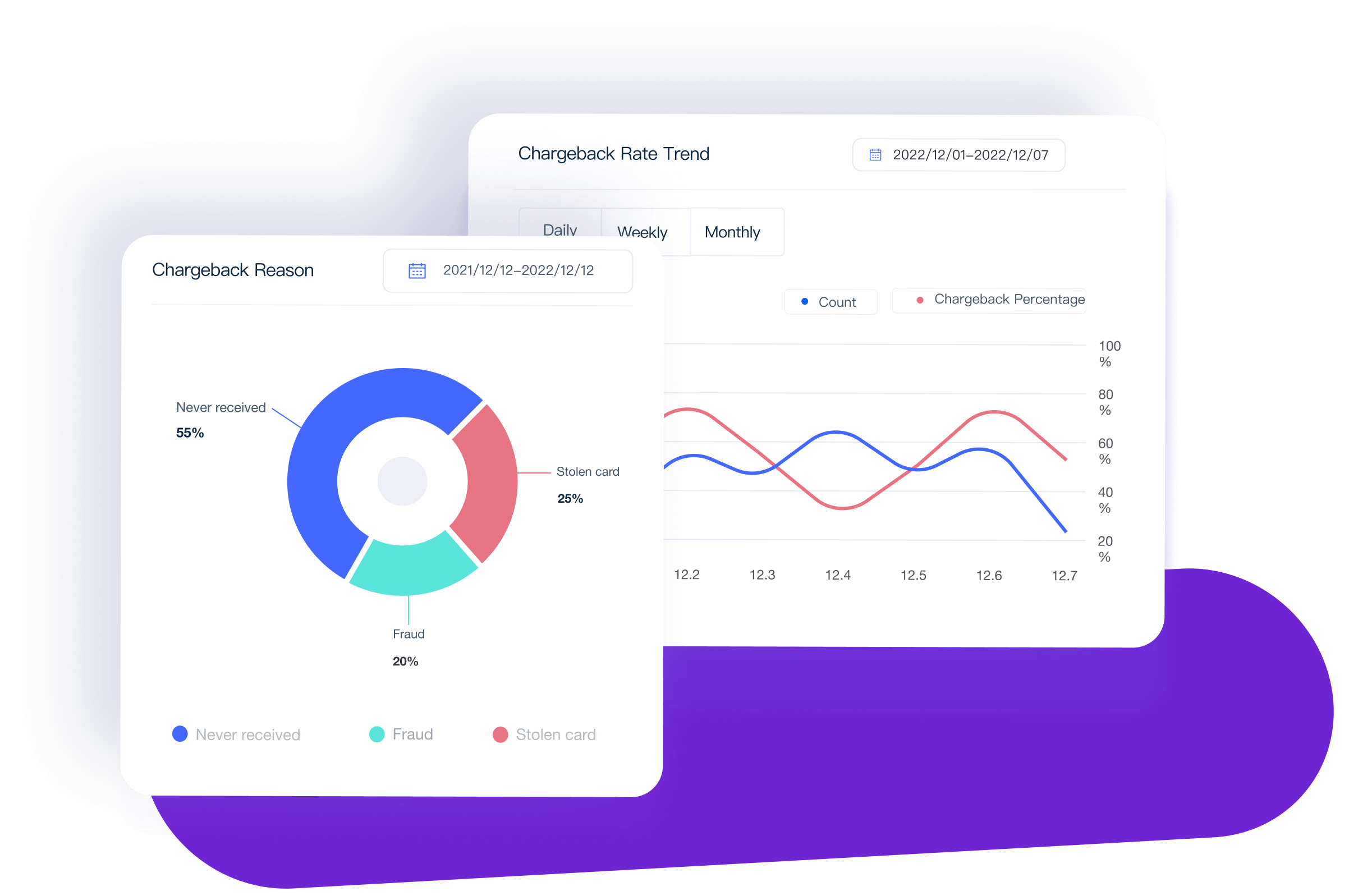

Effortless deployment of a holistic fraud shield

One stop shop, with easy implementation of a multi-layered payment fraud prevention approach that incorporates velocity rules, block/trust list functions and other customized rules, and configurable tools such as 3DS and pre-auth

Enhanced fraud detection accuracy

Post transaction fraud detection that lifts the accuracy and allows proactive mitigation prior to chargebacks

Ready to Grow Your Business with Liquido?